Balanced Purchase Process

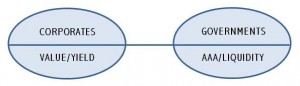

As part of our balanced portfolio management, we employ a fixed income approach using intermediate government and corporate bonds to create a “barbell of quality” structure, which produces a short average maturity with a higher than average yield. The two primary characteristics we look for in corporate bonds are attractive yield spread over treasuries and potential upgrades in quality ratings over the next several years. Analysis of quality rankings, sector spreads, and the business cycle helps us determine which investment grade corporate issues to select. Our focus is primarily toward the lower end of the investment-grade scale for yield enhancement to the portfolio. Bond ideas also come from our equity research. This equity work allows us to discover quality companies that may be at the trough of their economic cycle. Our fixed income research is fundamental in nature, and primarily performed in-house. U.S. Treasury and Agency bonds are purchased to provide liquidity.

We structure our fixed income portfolios to provide stability and income. Typically, we maintain an average maturity in the two- to five-year range and will generally not exceed ten years in maturity as the longer the maturity, the higher the volatility. Based on the shape of the yield curve, our interest rate forecast and the absolute level of interest rates, we will shift the average maturity of the fixed income portfolio. U.S. government bonds will equal 5-10% per position and corporate bonds will equal 3-5% per position of the bond portion of the portfolio. Our final fixed structure will be based on our security selection, shape and level of the yield curve, and interest rate forecast.

We do not make significant changes to the portfolio to manipulate duration. We will shift duration depending on our interest rate outlook and risk / reward perceptions. The frequency of these changes is a function of changing market conditions.

We do not make significant changes to the portfolio to manipulate duration. We will shift duration depending on our interest rate outlook and risk / reward perceptions. The frequency of these changes is a function of changing market conditions.

The process for making asset mix decisions for a balanced portfolio is twofold. First, economic and interest rate analyses are performed. From this we develop expected return projections for the security markets. Next, each client’s investment objectives, risk tolerance and constraints are considered. In general, equities comprise 40%-70%, fixed 20%-50%, and cash is a by-product of security selection. Asset mix changes tend to be gradual shifts over time based on valuation, security selection and business cycle consideration.