Equity Purchase Process

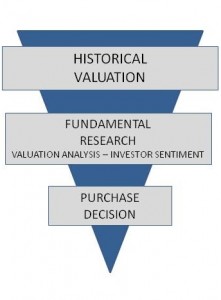

The overall investment process includes analyzing historical valuation ranges, researching company fundamentals, reviewing investor sentiment, and developing price targets. Using a large capitalization universe of approximately 1,000 companies, our research group screens five historical valuation factors: price/sales, price/book, price/cash flow, price/earnings and dividend yield. Based on these factors, stocks trading in the bottom third of their ten-year historical ranges are identified.

These stocks are examined further from a fundamental standpoint. This fundamental analysis includes a detailed historical review of a company’s profitability, financial flexibility, return on capital and management’s track record. The objective of our fundamental effort is to identify catalysts that will be long-term drivers of value growth. Additionally, investor sentiment is judged by reviewing Wall Street buy and sell recommendations, evaluating the tone of written research, and institutional commitment.

The investment team then develops a case outlining valuation, fundamentals and sentiment. Using this research, three price targets are established. Downside, fair and full value targets are calculated using a 12 to 18 month horizon. The last step in our approach is the purchase decision. At this time, the investment case is discussed and debated. Each security is then voted upon with the resulting purchase and weighting decisions made at this level. The initial inclusion of a new security into the portfolio only occurs when the stock price is at a substantial discount to our value, thus giving us a significant margin of safety.

The investment team then develops a case outlining valuation, fundamentals and sentiment. Using this research, three price targets are established. Downside, fair and full value targets are calculated using a 12 to 18 month horizon. The last step in our approach is the purchase decision. At this time, the investment case is discussed and debated. Each security is then voted upon with the resulting purchase and weighting decisions made at this level. The initial inclusion of a new security into the portfolio only occurs when the stock price is at a substantial discount to our value, thus giving us a significant margin of safety.

Holdings are reviewed on an ongoing basis with reports being distributed weekly. Portfolios hold an average of forty to fifty issues. Initially we will purchase a 1-3% position. We will add to partial positions as issue or market weakness permits. Our maximum allocation to a single issue will be 4% at cost, 7% at market.